How OD Stays Stable

If the price of OD deviates from its $1.00 peg, the PID Controller adjusts the redemption rate upwards or downwards in order to incentivize vault managers to restore it.

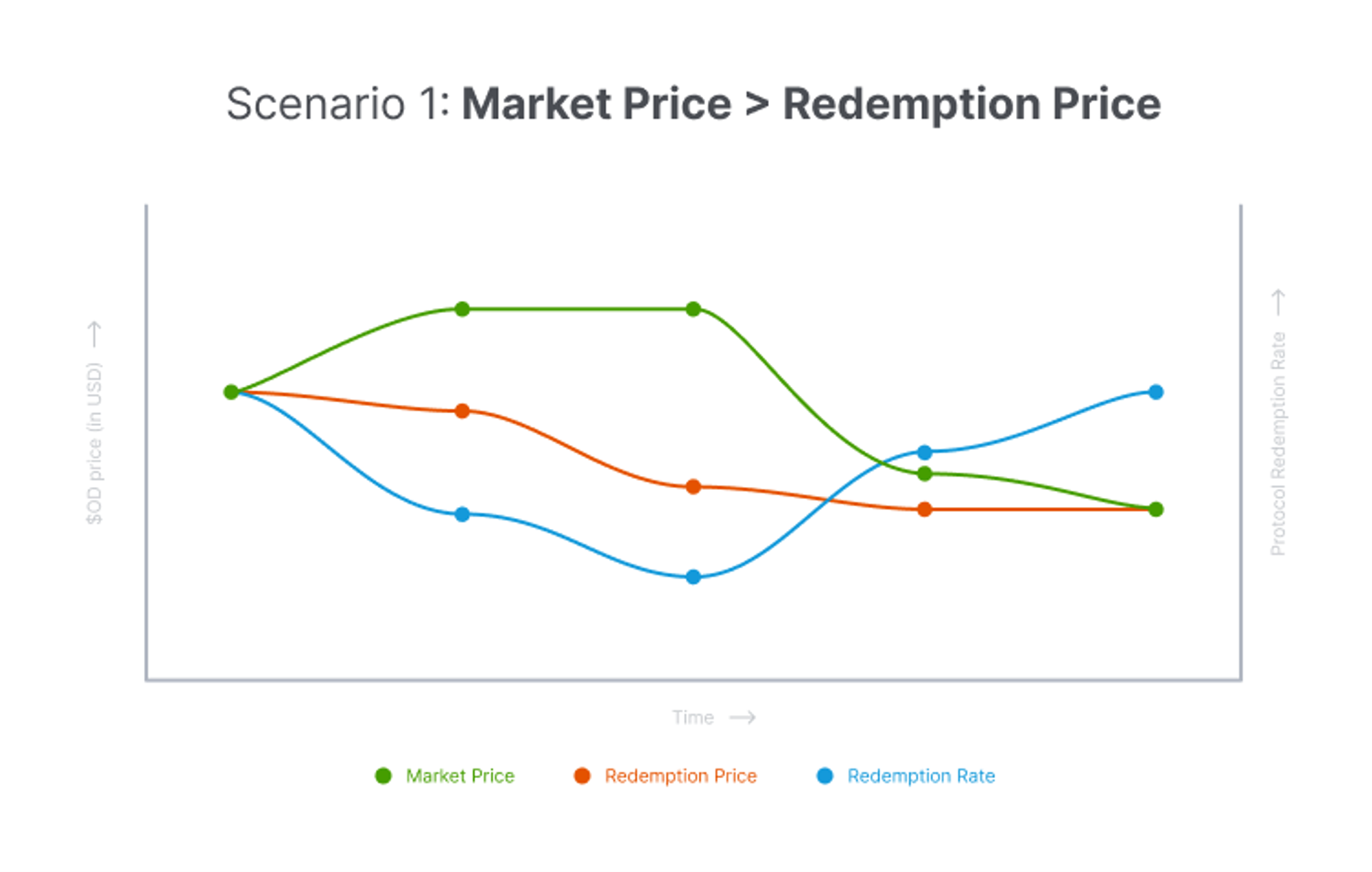

The following are two scenarios and how this works:

If the market price is greater than the redemption price, the redemption rate turns negative. A negative redemption rate lowers the redemption price.

Since OD is now cheaper inside the protocol compared to the market, borrowing power increases. Users are incentivized to borrow more OD and/or sell it at market price as an arbitrage opportunity. The increased sell pressure lowers the market price and the redemption price continues to lower until the market price reaches it.

Example: If the redemption price of OD decreases by 0.2%, users can leverage their collateral to borrow 0.2% more OD from Open Dollar. They then sell their OD at market price, earning a profit from the price deviation, and protecting themselves from a drop in the token’s value following the negative redemption rate.

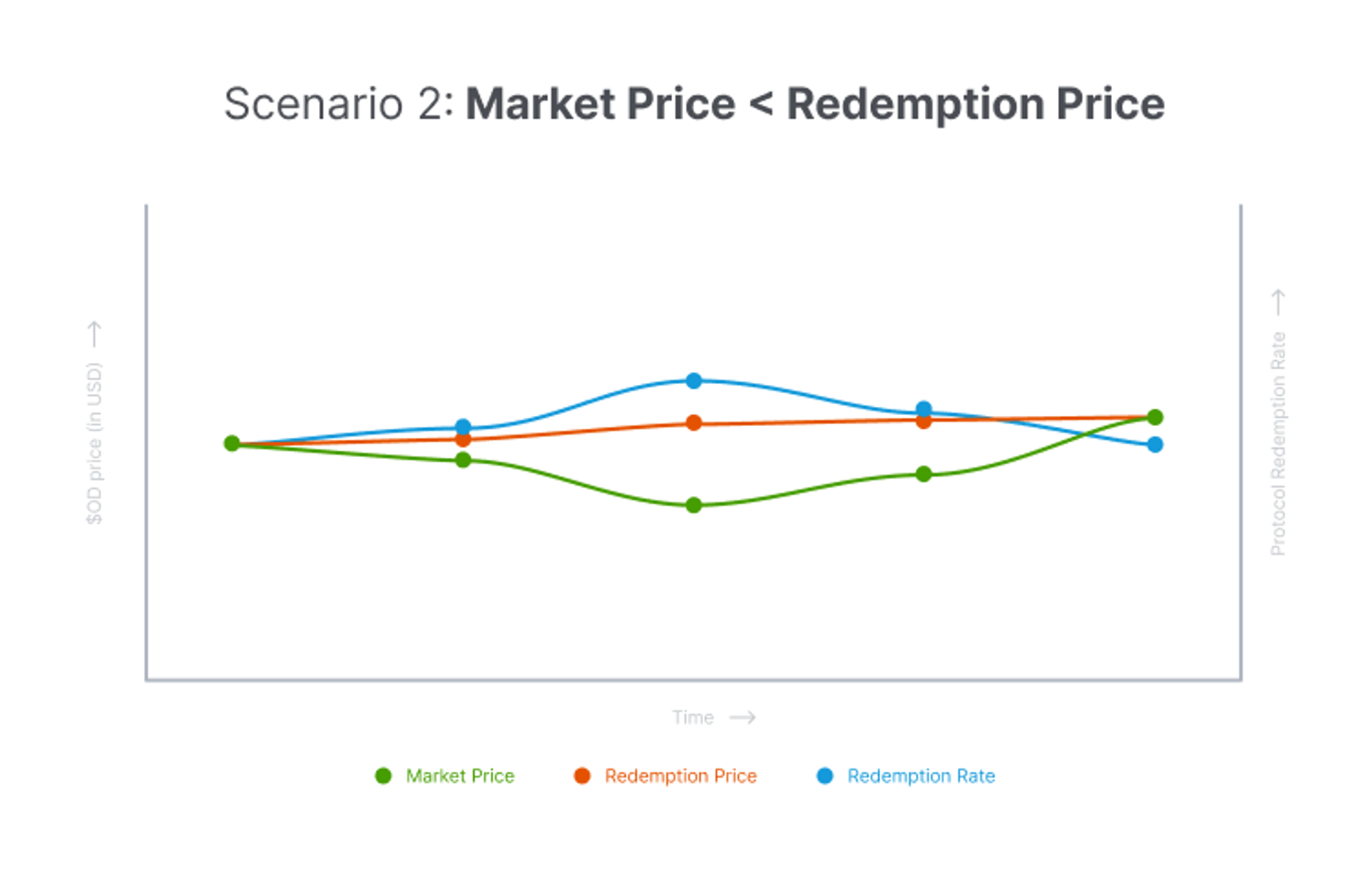

This process also works in reverse. If the market price of OD falls below the redemption price, the redemption rate turns positive. This increases the price of accumulated debt which causes users to buy more OD from secondary markets to pay it down. It also incentivizes them to buy more OD with the expectation that the market price will follow a similar trajectory to the redemption price.

Example: If the redemption price of OD increases by 0.2%, users need to buy 0.2% more OD to redeem their collateral. They can also buy more OD at market price and sell it when the market price matches the redemption price (+0.2%).

In both scenarios, the process continues until the deviation between the market and redemption price is reduced to 0.

Note: Open Dollar doesn't change the amount of OD you hold. It only changes the target price that the protocol wants

OD to have on exchanges. Therefore, it is not a rebase token, but rather a stablecoin with a floating redemption price.

For more details and a simplified example, see our blog article.